- 2024-06-09

Central bank gold buying picks up in April

Net purchases totalled 33t in April, rebounding from a revised net 3t in March

Broad buying from several emerging market banks offset negligible sales

June sees the release of findings from our Central Bank Gold Survey 2024.

The rapid rise in the gold price during March raised several questions. One of these was whether central banks – whose demand has been posited as a key reason for the recent rally – would change their gold buying behaviour in response.

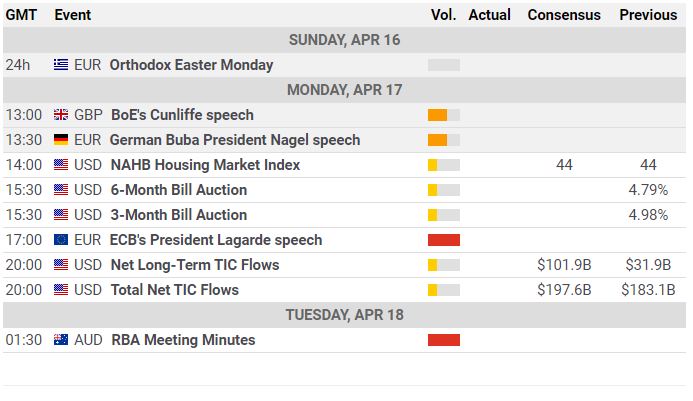

We now have the benefit of a more complete picture for March, as well as initial data for April, to help inform our perspective. Latest figures – reported via the IMF and publicly available sources – show that global gold reserves rose by a net 33t in April, similar to levels seen in February (27t).1 Although gross purchases dipped to 36t, from 39t in March, gross sales saw a more pronounced m/m drop from 36t to just 3t in April.

Central bank net buying rebounds in April

Monthly central bank gross purchases and sales, tonnes*

Central bank net buying rebounds in April

*Data to 30 April 2024 where available.

Source: IMF IFS, respective central banks, World Gold Council

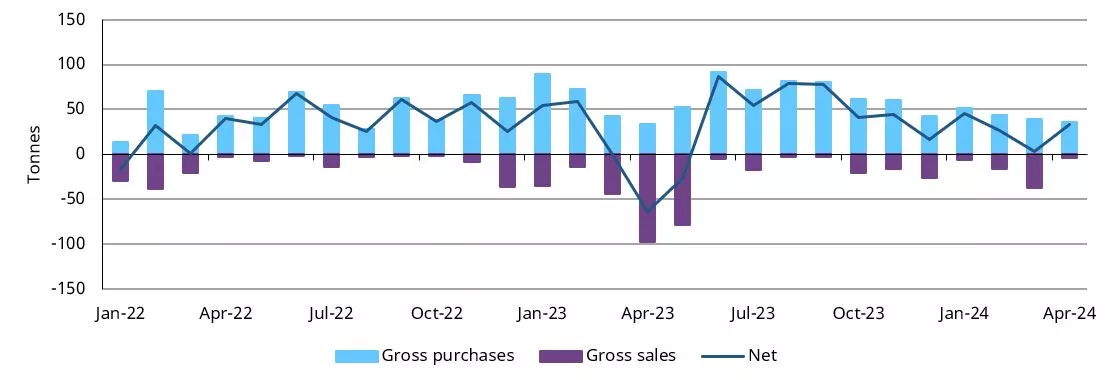

Eight central banks increased their gold reserves by a tonne or more in April. The Central Bank of Turkey was the largest buyer, increasing its official reserves by 8t.2 With 11 consecutive months of buying, the bank’s y-t-d net purchases now total 38t and lift its total official gold holdings to 578t. The National Bank of Kazakhstan (6t), Reserve Bank of India (6t), National Bank of Poland (5t), Monetary Authority of Singapore (4t), Central Bank of Russia (3t) and Czech National Bank (2t) were the other major buyers in the month.

The Peoples Bank of China reported a significant slowdown in its gold buying. The bank reported that its gold reserves rose by just under 2t in April to 2,264t – the lowest monthly increase since it resumed reporting in November 2022 and well below the 18t monthly average prior to April.

Notable gross sales were limited to the Central Banks of Uzbekistan and Jordan. Both reported a 1t decline in their gold reserves, a notable reduction in the pace of selling seen in February and March.

Central bank gold demand remains healthy so far in 2024

Y-t-d net purchases/sales of a tonne or more by central bank*

Central bank gold demand remains healthy so far in 2024

*Data to 30 April 2024 where available.

Source: IMF IFS, respective central banks, World Gold Council

Looking back at March, net purchases for the month have been revised to just 3t following the late reporting of a 12t sale by the Central Bank of the Philippines. While gross purchases during March were relatively stable in the face of the rapidly rising gold price, gross sales saw a marked pick-up thanks to heavy sales from (now) four banks . This suggests that price performance may well have had some impact on the activity of some central banks.

Despite the slowdown in March, the preliminary pick-up in net purchases in April may suggest that central banks have thus far shaken off the rally in the gold price and continue with their strategic buying plans. Of course, more data for April, as it becomes available, as well as data for May, will be instructive to further assess how central banks’ approach to gold purchases will evolve. In addition, June sees the publication of findings from our Central Bank Gold Survey 2024, which will provide a rich insight into central banks’ thinking towards gold, and how this may influence gold buying going forward.

Footnotes

1 Based on monthly IMF IFS data (reported with a two-month lag) and supplemented with data from respective central banks where applicable. Most institutions report on a regular basis, but some may report with a – sometimes significant – delay. Late availability of data may lead to revisions. The data reported here informs, but is distinct from, the central bank demand estimates we report in Gold Demand Trends.

2 Turkey’s official sector gold reserves are the sum of central bank-owned gold and Treasury gold holdings. This is equivalent to gross gold reserves less all gold held at the central bank in relation to commercial sector gold policies (such as the Reserve Option Mechanism (ROM), collateral, deposits and swaps). For information on this methodology, click here.