- 2023-04-17

Golden Fundamental Overview

Gold price attracts fresh buying near the $1,995 area on the first day of a new week and maintains its bid tone through the first half of the European session. The XAU/USD is currently placed around the $2,010-$2,011 region, up over 0.40% for the day, and for now, seems to have stalled Fridays retracement slide from the vicinity of over a one-year peak.

Looming recession fears benefit the safe-haven Gold price

Growing worries about a deeper global economic downturn turns out to be a key factor lending some support to the safe-haven Gold price amid expectations for an imminent pause in the rate-hiking cycle by the Federal Reserve (Fed). That said, impressive bank earnings seem to have eased fears about a banking crisis that unfolded in March. Adding to this, the Retail Sales report released from the United States (US) on Friday suggested that the economy is not so bad and remained supportive of a generally positive tone around the equity markets. This, along with a modest US Dollar (USD) strength, is holding back bulls traders from placing aggressive bets around the XAU/USD and capping the upside, at least for the time being.

Modest US Dollar strength keeps a lid on Gold price

Despite the softer US consumer inflation and the Producer Price Index released last week, Fed Governor Christopher Waller on Friday called for further rate hikes and said that the job was still not done as inflation remains far too high. The markets were quick to react and are now pricing in a greater chance of another 25 basis point (bps) lift-off at the next Federal Open Market Committee (FOMC) policy meeting in May. This remains supportive of elevated US Treasury bond yields, which, in turn, assists the USD to build on Fridays goodish rebound from a one-year low and gain follow-through traction for the second successive day. A stronger Greenback tends to undermine demand for the US Dollar-denominated Gold price.

Traders now look to US macro data for short-term impetus

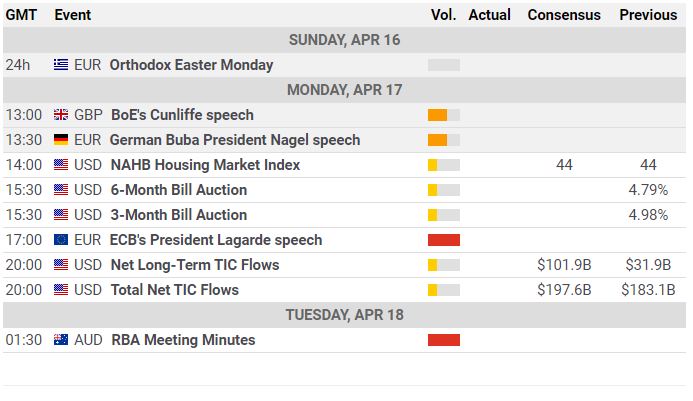

The aforementioned mixed fundamental backdrop warrants some caution before positioning for any further appreciating move for the XAU/USD. Nevertheless, Gold price manages to hold above the $2,000 psychological mark as traders now look to the US economic docket, featuring the release of the Empire State Manufacturing Index for a fresh impetus later during the early North American session. Apart from this, the US bond yields will influence the USD price dynamics, which, along with the broader risk sentiment, should contribute to producing short-term opportunities around the XAU/USD.